franchise tax bd des

At issue is whether the franchise tax applies to Swart whose sole connection with California is a 02 percent ownership interest in a manager-managed California limited liability company investment fund Cypress LLC. 1 Best answer Accepted Solutions AnthonyC.

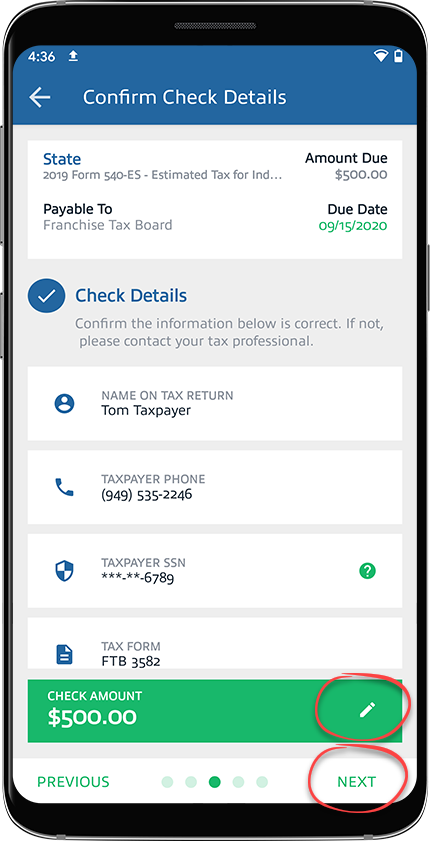

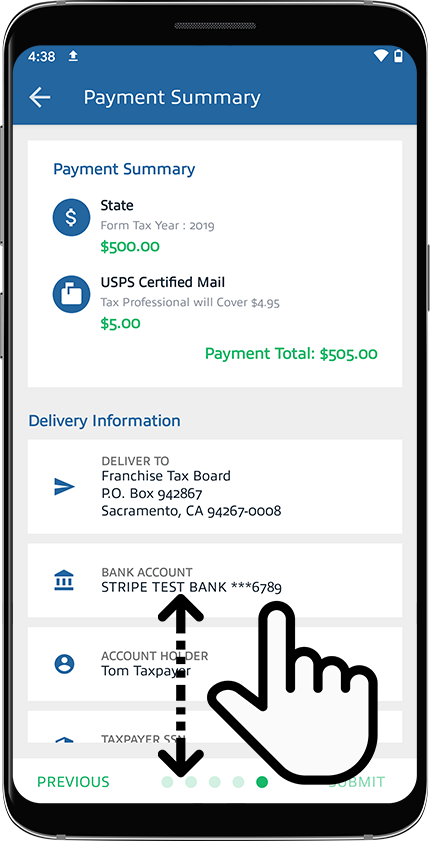

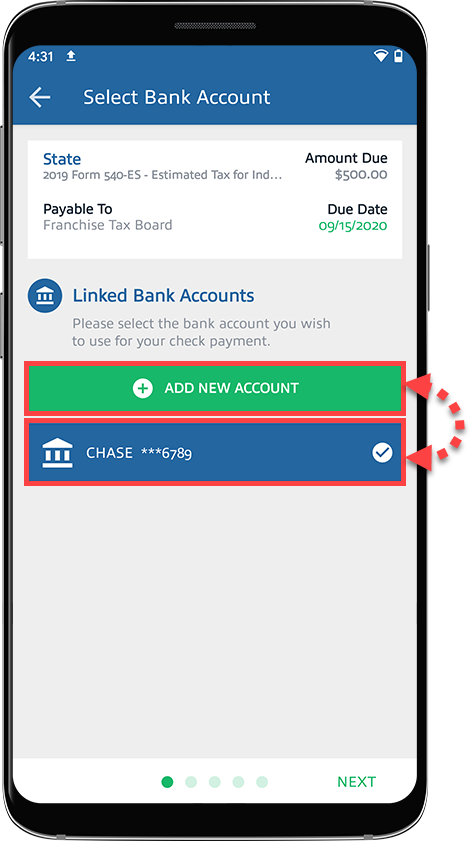

Paying Tax Payment By Check Taxcaddy

A franchise tax is a levy paid by certain enterprises that want to do business in some states.

. I think in 2013 I did end up owing right around the amount that was deposited to the state and I paid it on some. Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham. Thus in 1993 the Board launched an audit to determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency.

No the Franchise Tax Board is a tax agency that enforces and collects state income and franchise taxes. Franchise Tax Payment Due to Corporations USA by February 15 2022. I have a traffic ticket which I extended the court date 3 months later.

Department of Treasury that enforces federal income tax laws and processes tax returns to businesses and individuals. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund. 0 7 33802 Reply.

It employs the unitary business principle and formula apportionment in applying that tax to corporations doing business both inside and outside the State. The Internal Revenue Service is a federal bureau of the US. Contrary to what the name implies a franchise tax is.

For both New York State corporation franchise tax purposes and federal income tax purposes US BD and US AM were treated as disregarded entities. Appellant Franchise Tax Board is a California agency charged with enforcement of that States personal income tax law. Franchise tax bd casttaxrfd 6753K views Discover short videos related to franchise tax bd casttaxrfd on TikTok.

On Petitioners originally-filed Forms CT-3 for the years at issue 2012 and 2013 it sourced US BDs receipts using special. Effective January 1 2018 a domestic stock or non-stock for profit corporation incorporated in the State of Delaware is required to pay annual franchise tax. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web Accessibility Initiative of the World.

There are 7222 searches per month from people that come from terms like franchise tax bo or similar. The minimum tax is 17500 for corporations using the Authorized Shares method and a minimum tax of 40000 for corporations using the Assumed Par Value Capital Method. January 10 1983 Decided.

I was supposed to get 4700 something. Opn and reconsider the cause in light of Microsoft Corp. Thus in 1993 the Board launched an audit to determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency.

Appellant Franchise Tax Board is a California agency charged with enforcement of that States personal income tax law. The Franchise Tax Board is California state governmental agency that is responsible for collecting individual income taxes for California residents. As such they were treated as intra-corporate divisions of Petitioner.

Appellant Franchise Tax Board of the State of California FTB subsequently audited Hyatts 1991 California tax return and initially determined that Hyatt did not move to Nevada until April 1992. The measure of the tax is limited to income reasonably attributable to sources in California. This also happened to me.

Includes 300 submission fee 55 annual registered agent fee and 10 access fee. Typically if your business is required to register. Code 23151 fn.

California law authorizes appellant to require any person in possession of credits or other personal property or other things of value belonging to a taxpayer. The court concluded that passively. Franchise Tax Board July 28 2005 A102915 2005 WL 1785249 nonpub.

In addition the board collects business and corporate taxes from entities that operate in this state. File a return make a payment or check your refund. Swart is a small family-owned corporation incorporated in Iowa with its place of business and headquarters in Iowa.

Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham. Follow the links to popular topics online services. Log in to your MyFTB account.

Hyatt or Hyatt III 587 US. I received a deposit from franchise tax board not matching what my tax return said do I receive my tax return in amounts. Watch popular content from the following creators.

It comes from Panama. I got it in my bank account but Im not sure if its my tax return. FRANCHISE TAX BD1983 No.

FTB assessed a deficiency and imposed fraud penalties against Hyatt for the 1991 and 1992 tax years totaling over 13 million. This matter has been remanded by the Supreme Court S136922 with directions to vacate our previous decision The Limited Stores Inc. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year.

For Corporations with more than 5000 shares please call us at 1-866-460-1672. Hall 1979 Franchise Tax Board of California v. Do I have to pay a franchise tax.

FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. The Franchise Tax Board is a government agency in the state of California. California Franchise Tax Board.

___ 2019 was a United States Supreme Court case that determined that unless they consent states have sovereign immunity from private suits filed against them in the courts of another state. Nancytjensonrealtornancytjenson_realtor Diana Sumberlindianasumberlin bossl8tbossl8t Small Biz Attorneythelegalpreneur Karlton Denniskarltondennis. The franchise tax is impressed annually on corporations for the privilege of exercising the corporate franchise within California.

California imposes a corporate franchise tax geared to income. FRANCHISE-TAX-BO-PAYMENTS has been in the DB for a while it is the number 23352.

Paying Tax Payment By Check Taxcaddy

Franchise Tax Board Webpay Youtube

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Is Franchise Tax Bd Casttaxrfd Solution Found

Monopoly Streets Playstation 3 Monopoly Playstation Games

California Ftb Rjs Law Tax Attorney San Diego

Paying Tax Payment By Check Taxcaddy

Golden State Stimulus I Ftb Ca Gov

Franchise Tax Board Payments Arrcpa

Franchise Tax Board Payments Arrcpa

Franchise Tax Board Michael Kohlhaas Dot Org

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829